Key Factors Influencing Commercial Property Prices:

- Prime Locations

Commercial properties in India’s major cities are highly sought after due to their strategic positioning near key locations-

a) Transportation Hubs: Proximity to airports, metro stations, and bus terminals improves accessibility.

b) Amenities: Nearby restaurants, hotels, and shopping centers make these locations convenient for business operations.

c) Customer Foot Traffic: Prime locations attract higher footfall, enhancing business visibility.

d) Key Business Districts: Being close to other businesses boosts networking opportunities and credibility.

- Higher Rental Income Potential

Commercial properties generate more rental income compared to residential properties due to –

a) Higher Income-Generating Capacity: Businesses generally have a greater earning potential than individual tenants.

b) Multi-Tenancy: Commercial buildings often accommodate multiple tenants, diversifying and increasing revenue streams.

c) Longer Lease Terms: Commercial leases typically range from 5 to 10 years, offering property owners stability and predictable income.

- Costly Development

Developing commercial real estate involves stringent requirements and substantial investment in-

a) Regulations and Building Codes: Commercial projects must adhere to complex building codes.

b) Advanced Amenities: Features like high-speed internet, energy-efficient HVAC systems, robust security, and modern elevators enhance property value.

c) Specialized Facilities: Additions like loading docks, conference rooms, and warehouse spaces cater to specific business needs.

- Longer Lease Terms

Commercial leases offer predictability, allowing property owners to-

a) Secure Better Financing: Stable lease terms make commercial properties more appealing to investors.

b) Plan Long-Term Maintenance: Property owners can schedule upgrades and maintenance more effectively.

- Property Management Considerations

Managing commercial properties involves accommodating diverse tenant needs, maintaining advanced systems, and providing essential services, which leads to higher management costs.

- Additional Factors Influencing Commercial Property Value

a) Market Conditions: Economic growth and market demand significantly impact commercial property prices.

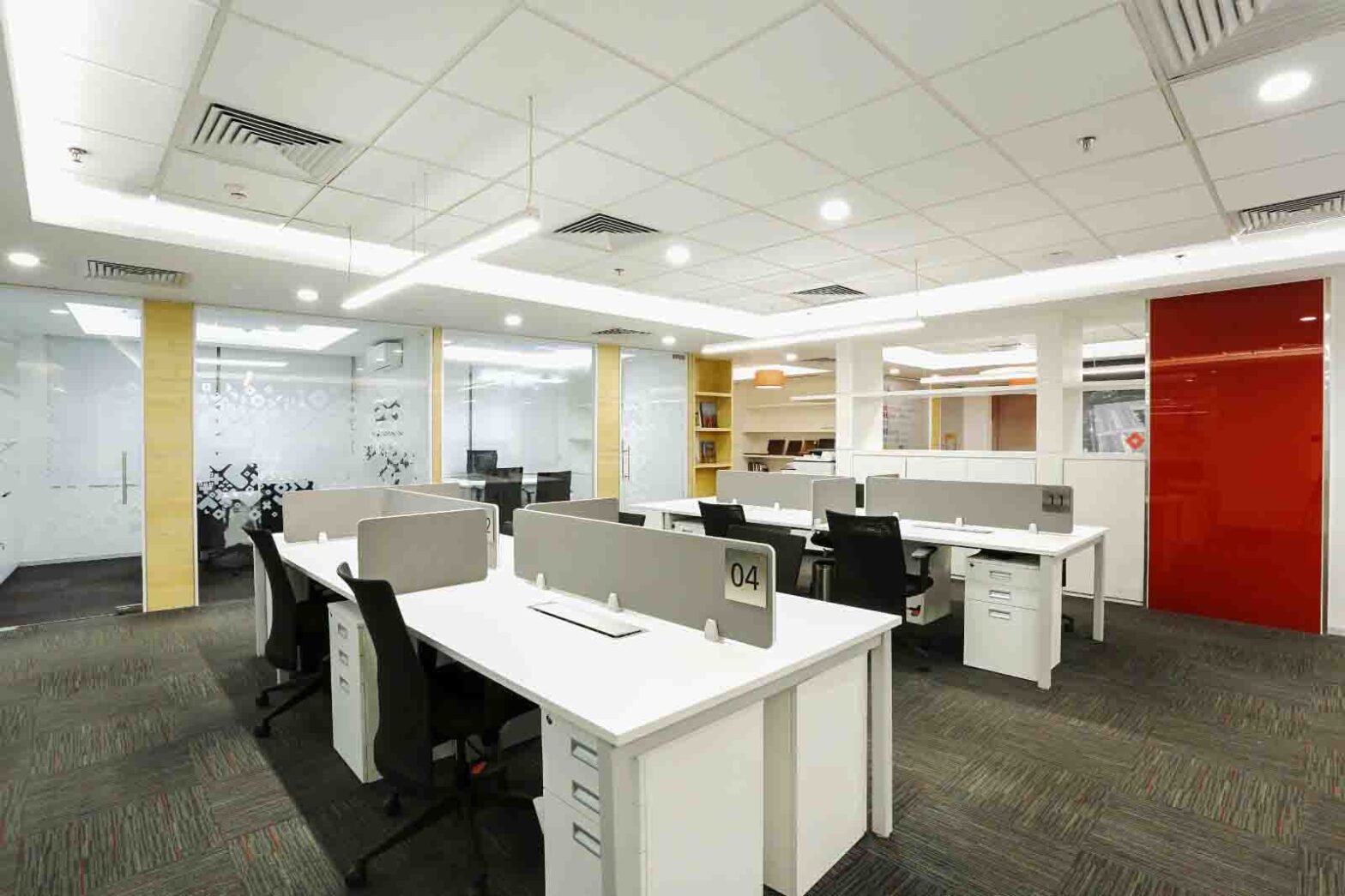

b) Property Type: Different types, such as office spaces, retail areas, and warehouses, cater to various business needs and have unique value propositions.

c) Building Age and Condition: Modern and well-maintained buildings fetch higher prices.

d) Tenant Creditworthiness: Properties leased to reliable, creditworthy businesses are valued more.

- Business Needs and Commercial Space Dependency – Commercial spaces support a wide array of business operations, including:

a) Administrative Offices: Offering meeting rooms and workspace environments.

b) Storage and Warehousing: For goods management.

c) Research and Development: For innovation and production spaces.

d) Customer-Facing Services: Retail and hospitality sectors.

Prime locations also offer businesses access to a skilled workforce, suppliers, and potential partners, driving the higher costs associated with commercial properties.

Conclusion

Understanding why commercial office spaces cost more than homes empowers investors and businesses to make strategic decisions. At Apeejay Real Estate, we provide prime commercial properties in India’s key business locations, designed to meet evolving business needs.

About Us

Apeejay Real Estate is a leader in developing premium commercial properties across India, committed to fostering business growth through world-class spaces.

Stay Informed

Follow our blog for insights into India’s commercial real estate market and expert advice on making the right investment decisions.

Contact Us

To explore our commercial properties, check our blogs and social media posts, and contact our team at 1800 274 1112.